- Current or fairly expected income otherwise assets (other than the worth of the house or property protecting the loan), that representative often rely on to repay the borrowed funds;

- Latest a job condition (for folks who have confidence in employment earnings whenever assessing a good member’s feature to settle the loan);

Additionally, both the laws additionally the upgraded CFPB Feature-to-Pay back and you can Accredited Financial Signal Short Organization Compliance Guide provide information and you can examples of compatible methods to assess, consider, and you may confirm each one of the over seven underwriting facts. 11

You are guilty of developing and you may using underwriting criteria for your borrowing from the bank connection and you may and then make change to those requirements throughout the years for the a reaction to empirical guidance and you may modifying economic and other conditions

12 You need to check out the ATR requirements in the context of the information and you will affairs highly relevant to the industry, field of membership, your own borrowing partnership, plus participants. If for example the records you review suggest there’ll be an improvement into the an excellent member’s installment ability once consummation (particularly intends to retire rather than receive the fresh a job, otherwise intends to payday loan Canaan changeover out-of full-for you personally to region-go out work), you should consider you to recommendations. not, you may not inquire otherwise verifications banned from the Controls B (Equal Credit Opportunity Work). 13

Brand new ATR requisite cannot ban any type of loan has or exchange types. not, you may not generate a safeguarded mortgage so you’re able to a member in the event that you don’t create a good, good-trust devotion the user has the capacity to pay back the latest financing. So, if you underwrite finance which have nontraditional has, such desire-merely otherwise bad-amortization episodes, you ought to imagine a good member’s power to pay back the borrowed funds just after the original months. To possess high-listed balloon financing that do not qualify off a good balloon-payment QM (discussed later on inside Regulating Alert), you will want to underwrite brand new balloon payment by itself.

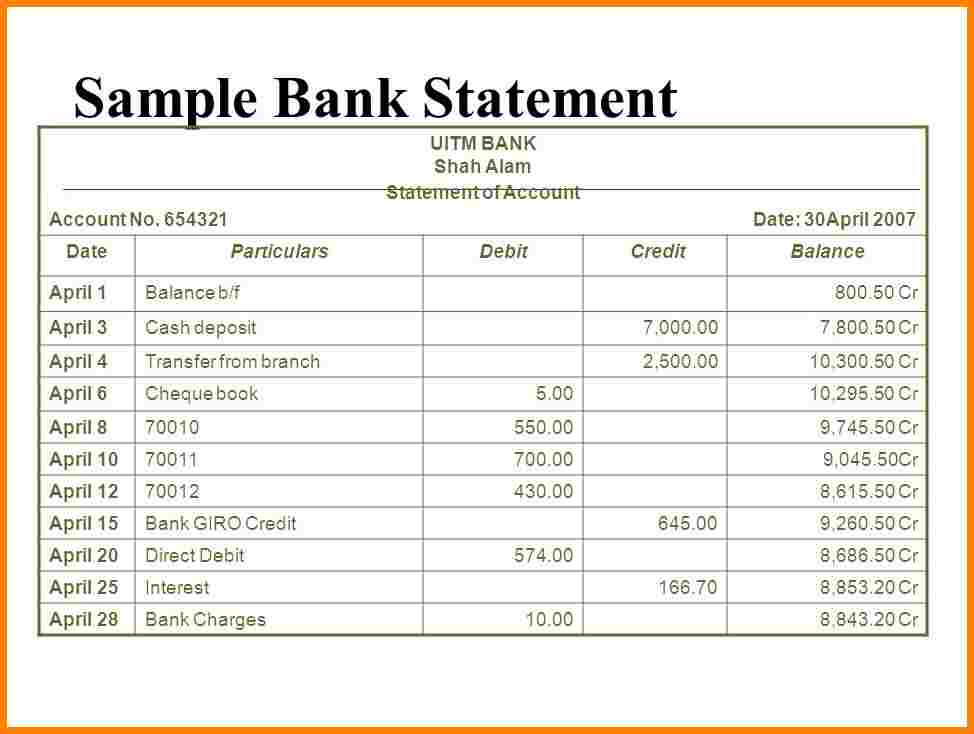

You need to be sure all the details you rely on to really make the ATR determination playing with relatively credible 3rd-cluster details. 14 Like, you should be sure a good member’s income using files such as for example W-2s or payroll statements. You may need to believe in user-supplied earnings records. These records try fairly credible third-people information towards the the total amount an appropriate 3rd party features assessed all of them. fifteen

You ought to retain evidence you complied for the ATR/QM code to possess a minimum of 3 years immediately after consummation. sixteen Even though you commonly expected to keep genuine report copies of one’s files found in underwriting a loan, you need to be in a position to reproduce for example details precisely.

The compliance on ATR conditions lies in everything offered during origination out-of a protected mortgage. 17 It is not a ticket of your own ATR standards in the event that a member you should never pay a protected mortgage loan only because of a-sudden and you may unanticipated job loss once you started the borrowed funds. Brand new ATR devotion relates to suggestions understood from the otherwise in advance of consummation.

In the event your borrowing partnership cannot already verify the 7 ATR underwriting circumstances, you need to create or boost their verification, quality assurance, and compliance assistance appropriately

At the same time, the laws provides you to definitely a part may bring a legal step up against a credit partnership under TILA having low-conformity with the ATR conditions. 18 As a result, in the event that players have trouble repaying protected money you originate, they may claim you failed to make a reasonable, good-faith commitment of the power to pay back one which just produced this new mortgage. In the event the an associate demonstrates this claim within the courtroom, you might be responsible for, on top of other things, up to 36 months out of financing charge and you can charges the fresh new associate paid back, while the member’s judge costs. There was a great about three-seasons law out of limitations to the ATR says put because affirmative circumstances (head says up against a collector getting damages having a keen ATR pass). Immediately after 36 months, people results in ATR says merely given that a security to foreclosure as an element of setoff otherwise recoupment says.