Sure, usually you ought to get a house assessment to have a great cash-away refinance. This new appraisal gets a formal aspect of home’s well worth, that may decide how much money you could bucks-out.

Exactly how much Do i need to Dollars-Away?

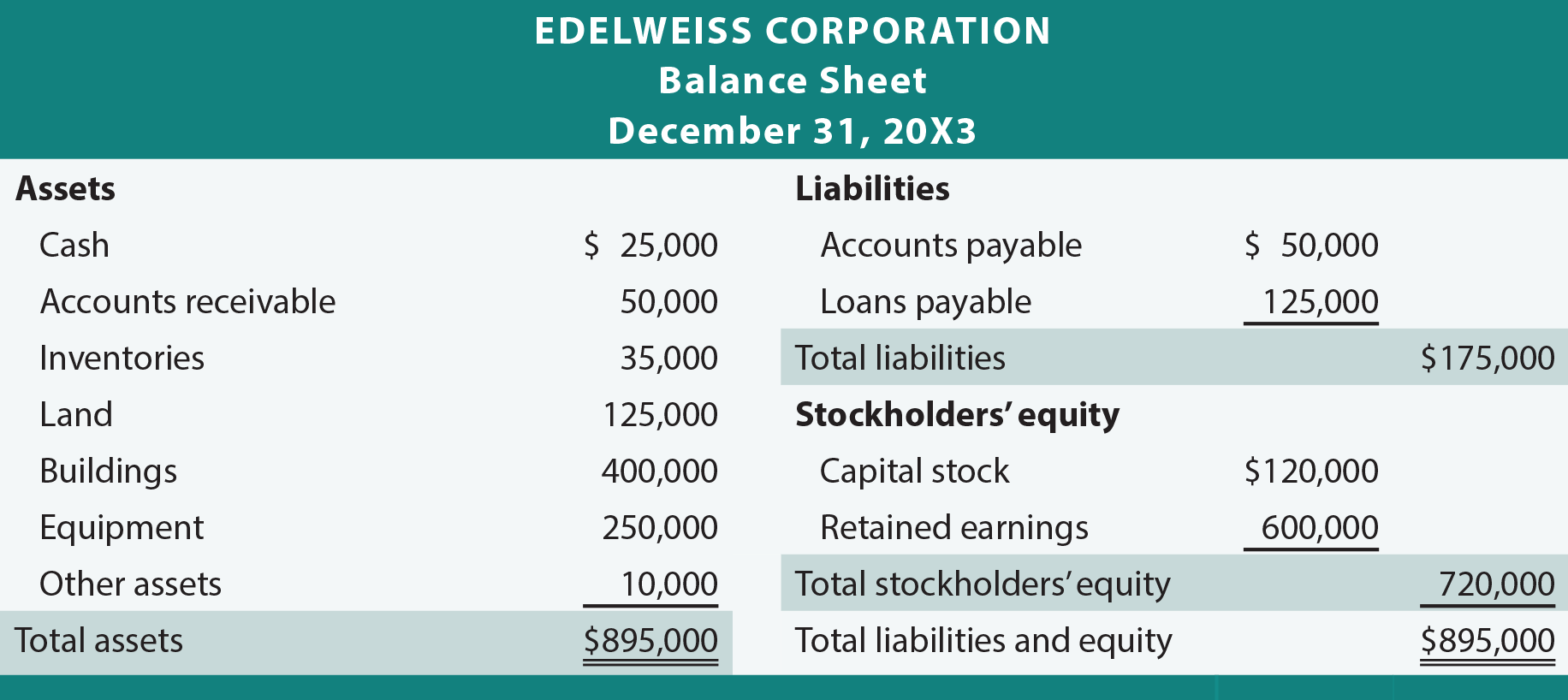

Say you’ve got a good $eight hundred,000 financial thereby far, you’ve paid back $250,000, leaving an unpaid equilibrium out-of $150,000. If you find yourself wanting to availableness $100,000, your mortgage amount will be $250,000. That is $150,000 for the kept harmony, and $100,000 into the equity you’re opening. Keep in mind that probably you is not able in order to take out 100% of your home’s guarantee the brand new maximum LTV (loan-to-worth ratio) is commonly 80%. This post doesn’t come with a lot more charges in the refinancing will cost you.

Some thing! It is your own. Although not, just like the you’ll be make payment on money back, it seems sensible to use it to own sensible investments, such as home improvements. This adds worthy of to your residence, so you could be capable of getting alot more for it when it comes down for you personally to sell. Reported by users, You have to spend money to generate income.

Most other well-known standard purposes for so it currency were consolidating higher-desire credit card debt, which will assist boost your credit rating. You might also put money into your youngster otherwise grandchild’s upcoming because of the deploying it for educational costs. Yet not, you can use it in fashion! Just be sure that one may keep up with your new repayments.

When i Do a funds-Aside Refinance, When as well as how Manage We Have the Money?

Typically, you get the money during the a lump sum payment on closing. But not, if you have a rescission period, gives you day immediately after closure so you can rescind the mortgage, you can easily wait until the end of that point to get your dollars.

Exactly what do I need To own a funds-Aside Re-finance?

- W-2s/Tax returns

- Spend Stubs

- Financial Statements

- Credit file (constantly a credit rating with a minimum of 580)

It’s also possible to you desire most other documents, based your role and you will financial. Concurrently, it’s important to observe that you will end up responsible for settlement costs, and any other variety of costs you incur.

Delivering bucks-out family refinance might be an intelligent move if you’d like cash and just have depending particular collateral. And, now could be a keen opportunistic time for you to re-finance! While you are prepared to access the residence’s equity that have a money-away refinance, you can make an application for home financing on the internet today.

Are you gonna be a beneficial Newrez Home Security Mortgage next financial otherwise a finances-away refinance? Apply to that loan manager to know about probably the most suitable mortgage street to you personally! Name now in the 888-673-5521!

2 The speed in your existing financial does not change. The fresh Newrez Family Equity Mortgage system needs borrower locate good second financial on most recent ount centered on underwriting recommendations. Lowest 660 credit rating. Minimal and limit loan number use. Program investment limited with the qualities having you to definitely current financial lien and you will susceptible to restriction financing-to-value ratio. Not available in all claims link or areas. Other terms and you will limits pertain. Excite e mail us to learn more.

step three By the refinancing an existing financing, the full finance fees could be large over the lifetime of the mortgage. We might import their escrow account balance from your own latest financing with the the brand new loan. In case the latest escrow count are decreased because of alterations in taxation or insurance rates, we may want more income once you close on the the fresh new financing.

2023 Newrez LLC, 1100 Virginia Dr., Ste. 125, Fort Washington, PA 19034. 1-888-673-5521. NMLS #3013 (nmlsconsumeraccess.org). Working given that Newrez Home loan LLC from the state out of Colorado. Alaska Lending company Licenses #AK3013. Washington Home loan Banker License #919777. Registered by Company away from Monetary Safeguards & Development under the California Domestic Financial Financing Work. Funds made or establish pursuant so you can a ca Money Loan providers Legislation license. Massachusetts Lender #ML-3013. Registered of the Letter.J. Department out-of Financial and Insurance policies. Authorized Financial Banker-NYS Banking Department. Most permits offered at newrez. That it telecommunications cannot make up a partnership in order to lend or perhaps the be sure out of a specified rate of interest. Funds protected of the an excellent lien against your house. Software needed and you can at the mercy of underwriting recognition. Only a few candidates was recognized. Rate of interest susceptible to transform due to business standards. Unless you lock in a performance once you use, the price at the closing may differ regarding the rate in place after you applied. Initial home loan top ount. Important information related specifically to your mortgage would be within the borrowed funds data, which alone will determine the legal rights and you may financial obligation under the loan bundle. Charges and you will charge use and may are different by product and you will jurisdiction. Call for details. Terms and conditions, requirements, and you can limitations use